The Balanced Scorecard is the most famous of the performance measurement systems that can be used to implement and monitor a new strategy or group.

What Is The Balanced Scorecard

The Balanced Scorecard is a short summary report of the key performance measures of a business, both financial and non-financial.

It tells the story of what the business is trying to achieve through its business strategy and how well it is succeeding in its implementation.

The Origins Of The Balanced Scorecard

Like many others who were using a broad mixture of measures to monitor performance in business in the late eighties and early nineties to overcome the shortcomings of traditional financial performance reporting (like driving by looking through the rear view mirror) I was astonished by how the idea of the balanced Scorecard caught fire as a bold, new concept.

Wikipedia reports that the first balanced scorecard was created by Art Schneiderman (an independent consultant specialising in the management of processes) in 1987 at Analog Devices, a semi-conductor company in the USA.

He shared his ideas with Robert Kaplan and David Norton and it became the basis for two popular articles in the Harvard Business Review and then a successful book.

- “The Balanced Scorecard – Measures that Drive Performance”, Harvard Business Review, Feb. 1992

- “Putting the Balanced Scorecard to Work”, Harvard Business Review, Sept. 1993

- “The Balanced Scorecard: Translating Strategy into Action” (1996)

Since then, Kaplan and Norton have extended the balance scorecard system with more books

- The Strategy-Focused Organization: How Balanced Scorecard Companies Thrive in the New Business Environment (2000)

- Strategy Maps: Converting Intangible Assets into Tangible Outcomes (2004)

- Alignment: How to Apply the Balanced Scorecard to Corporate Strategy (2006)

Before I go deeper into the Balanced Scorecard, let’s just step back and think about performance measurement as a general topic.

Introduction To Performance Measurement

“What gets measured gets done” may be a cliché but given the problems of implementing strategies it highlights the need to link performance measures with the developed strategy.

A performance measure has three key aspects:

- It communicates to staff that performance in the chosen area is important.

- It indicates the level of performance being achieved.

- It provides a benchmark and target for improvement efforts.

Establishing a measure allows the four basic performance management questions to be asked:

Traditional Performance Measures

Financial performance measurements often dominate the formal reporting in a business with the monthly management accounts and performance weekly or daily financial summaries.

But these are essentially looking backwards at the effects of past decisions rather than looking at whether the business is building the necessary capabilities for future success.

Financial forecasts of the future help because they focus attention on what may happen, but they are not the full answer for an effective performance measurement system.

Other non-financial information may be produced and distributed in the business but often there is little link between the different performance areas and the overall financial position of the business.

Sometimes there is a proliferation of measures with the inevitable confusion. Here the problem is not having performance measures but having too many.

The Balanced Scorecard

The concept of the scorecard developed by Kaplan and Norton has been heavily publicised and promoted and it became another management fad to use and abuse. That undermines the contribution that a well-designed balanced scorecard can have in a business.

The Four Perspectives In The Balanced Scorecard

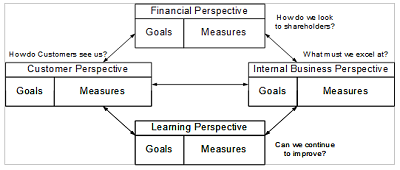

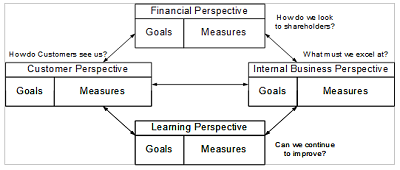

The idea of the balanced scorecard is to look at a limited number of measures that are balanced across four perspectives.

- Financial – how does the company look to its shareholders?

- Customer – how does the company look to the customer?

- Internal Process – is the company developing its internal processes to deliver the necessary performance for shareholders and customers?

- Learning and growth – is the company developing a capacity to develop the future?

Balanced Scorecard Performance Measurement System

The key aspect is that the measures in each of the perspectives must be linked by the business strategy in a unique series of cause and effect relationships. For example;

- We will make a profit because customers will buy sufficient quantity at a fair price and margin.

- Targeted customers will buy because the value we provide exceeds the price and the relative value offered from competitors.

- We are able to deliver that value because we excel at the necessary efficient internal processes.

- We will survive any attempts by our competitors to copy our advantage by continuing to innovate.

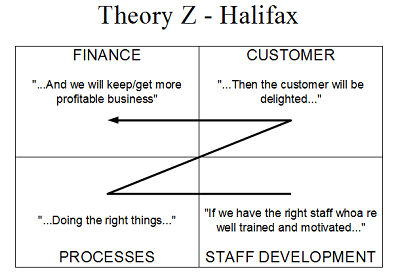

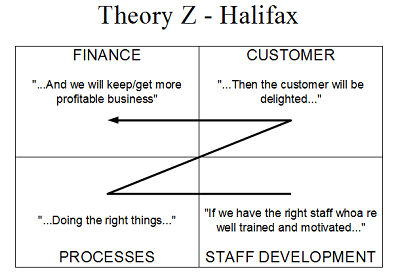

The scoreboard effectively tells the story of the strategy and its implementation. I like this Theory Z scorecard example from the old Halifax Bank in the UK.

After allowing for time-lags, performance in the balanced scorecard indicates whether the strategy is valid.

Different Measures For Different Functions And Levels

The scorecard is intended to give a top-level picture of the company’s current and intended performance across each of the four perspectives but it is essential that the objectives built in to the scorecard are cascaded down through the business.

The ultimate aim is for each person or team to have a series of objectives and measures that encourage everyone to act in a way consistent with the overall business strategy.

More Information About The Balanced Scorecard

At some stage I will be reviewing the books I’ve read on the balanced scorecard and the other performance measurement systems.

Have You Used A Balanced Scorecard?

If your business has developed a balanced scorecard or another performance measurement system to help you to implement your strategy I’m very interested to hear about your experiences.

Please leave a comment.