The Strategic Position and Action Evaluation Matrix or SPACE analysis matrix is a super technique for evaluating the sense and wisdom in a particular strategic plan. It was developed by strategy academics Alan Rowe, Richard Mason, Karl Dickel, Richard Mann and Robert Mockler and I don’t understand why it isn’t hugely popular.

Introduction To The Strategic Position and Action Evaluation Matrix aka SPACE Analysis

The Strategic Position and ACtion Evaluation (SPACE) analysis framework is a very useful but not well known tool to develop and review a company’s strategy.

It can be used at

- The beginning of the exercise to predict the overall key themes

. - As a check at the end of the process.

. - It can also be used to evaluate individual strategic options generated by using a tool like the Ansoff Growth Matrix.

SPACE Analysis is a systematic appraisal of four key issues that balance the external and internal factors that should determine the general theme of the strategy:

External

Internal

By combining ratings on each dimension on one SPACE matrix diagram, the framework guides the strategic agenda.

The dimensions are combined in a way that seems strange at first but makes sense because two sets of factors are assessed as strengths (financial strength and industry strength) and rated positive while the other two (competitive advantage and environmental stability) are assessed as potential weaknesses and rated negatively.

The logic is that financial strength is needed to compensate for environmental instability. The more difficult the future environment is thought to be, the more important it is to have strong financials.

Industry attractiveness and competitive advantage are seen as potentially alternative sources of superior profit and indeed there are treated as such in my five pathways to profit in my Profit Tipping Point report. If both favour the business, then results should be very good, if both are unfavourable, then the business is in trouble.

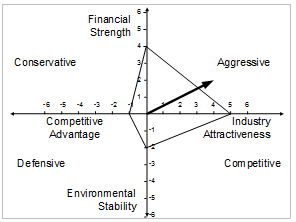

The SPACE Analysis Matrix Diagram

A very strong position in the SPACE matrix

This diagram shows that the firm is in a very favourable position and is able to take an aggressive growth strategy. It is operating in an attractive and stable industry and has major competitive advantages backed up by significant financial strength.

Assessing the SPACE Analysis Scores

Each factor in the Strategic Position and Action Evaluation matrix can be quickly judged but there are benefits for exploring each in detail.

There are many factors that can be considered and each industry will have its own key features which should be included in the detailed SPACE evaluation.

A few factors to be considered to give you a flavour of what to include in your SPACE analysis are listed below.

SPACE Analysis Factors For Financial Strength

- Return on Sales

- Return on Assets

- Cash Flow

- Gearing

- Working Capital Intensity

Financial Strength is scored 6 great to 1 poor in the SPACE Analysis Matrix – for more details see Financial Strength In The SPACE Matrix

SPACE Analysis Factors For Competitive Advantage

- Market Share

- Quality

- Customer Loyalty

- Cost Levels

- Product Range

Competitive advantage is scored -1 (minus 1) great to –6 (minus 6) poor – for more details see Competitive Advantage In The SPACE Matrix

SPACE Analysis Factors For Industry Attractiveness

- Growth Potential

- Life Cycle Stage

- Entry Barriers

- Customer Power

- Substitutes

Industry attractiveness is scored 6 great and 1 poor in the SPACE analysis matrix – for more details see Industry Attractiveness In The SPACE Matrix

SPACE Analysis Factors For Environmental Stability

- Political Uncertainty

- Interest Rates

- Technology

- Cyclical

- Environmental Issues

Environmental stability is scored –1 (minus 1) great to –6 (minus 6) poor – for more details see Environmental Stability In The SPACE Matrix

Scores switch between positive and negative so that the combined position can be assessed.

A firm operating with major competitive advantages in an unattractive industry will have a similar net score (and profitability potential) to another firm with little competitive advantage in an attractive industry.

e.g.

Attractiveness of industry 5 (very strong)

Competitive advantage -4 (weak – the business has more disadvantages than advantages)

Net SPACE score on this dimension = 1

or

Attractiveness of industry 2 (weak – things look difficult)

Competitive advantage -1 (the company has powerful competitive advantages over all the competitors)

Net SPACE score on this dimension = 1

The financial strength and environmental stability combination works the same way.

Interpreting the SPACE Analysis Matrix Diagram

The arrow indicating the strategic thrust can be drawn from the origin by calculating the net result on each axis and plotting this net position.

The alternative strategic thrusts in the SPACE matrix

The Aggressive posture in the SPACE Analysis Matrix occurs when all the dimensions are positive. The implicit strategy is to aggressively grow the business raising the stakes for all competitors. The main danger is complacency. For more details see Aggressive Strategy In SPACE.

The Competitive posture arises when a firm has strong advantages in an attractive industry but its financial strength is insufficient to compensate for environmental instability. The immediate strategy is to improve its financial strength (raising capital, improving profitability, merging with a cash rich parent) whilst maintaining its competitive position. For more details see Competitive Strategy In SPACE.

The Conservative posture arises when the firm is financially strong but is unlikely to make significant returns from the business. The strategy is to look for diversification opportunities in more attractive competitive situations. For more details see Conservative Strategy In SPACE.

The Defensive posture in the SPACE matrix occurs when all the dimensions are scored poorly. Firms in this position are very weak and heading for failure unless the external environment becomes more favourable. The firm will need to retreat from all but its strongest segments so that it can concentrate its limited resources on a turnaround. Fore more information see Defensive Strategies

Uncertain situations in SPACE Analysis

Sometimes the axis scores cancel each other out and the overall position falls between segments. However, by examining the four dimensions the strategic imperatives can be established – the internal dimensions are easier to change but the external dimensions indicate whether it is likely to be worthwhile.

For example if the Financial Strength is weak but the Environment Stability high then raising capital is appropriate but if the scores were the other way around then the business should be seeking to use its financial strength elsewhere.

Why Isn’t SPACE Analysis More Popular?

The first time I came across the SPACE analysis matrix when I was doing my MBA strategy course at the Manchester Business School and by then I’d read quite a few strategy textbooks and since then, many more books on strategy but SPACE analysis is hardly ever mentioned.

While the Strategic Position and Action Evaluation Matrix is a bit of a mouthful, it does describe the tool perfectly and SPACE is a great acronym.

I like SPACE analysis because it can be applied at many levels.

You can do the detailed analysis for each of the four SPACE dimensions and come up with a subjectively objective rating and crank out the numbers to find which posture is most suitable.

Or you can do a quick and dirty SPACE analysis based on a feel for the factors and quickly know the big issues the business g=faces and which direction its strategy should be taking.

The SPACE Matrix And The Six Step Profit Formula

It can be difficult to understand how various strategic planning models can help you to increase profit in your business which is why I use the Six Step Profit Formula as my model for profit improvement.

As well as helping you to think through the development of your starving crowd with the environmental stability and industry attractiveness dimensions in the SPACE Matrix, the competitive advantage dimension looks at your irresistible promise and whether you can reliably deliver it.

While the Six Step Profit Formula provides a roadmap for improving any business, the SPACE analysis assessment indicates whether the pay-off is likely to be enough reward for the time, energy and money invested.

The SPACE Matrix & Other Strategic Planning Models

The SPACE analysis matrix is one of my favourite strategic planning models which can help you to organise your thoughts and conclusions from the other strategy models.

Environmental stability and industry attractiveness draw on PEST Analysis and Porter’s Five Forces model. Your thinking on competitive advantage can be guided by the generic strategies, value disciplines, the value chain and customer value management.

Have You Used SPACE Analysis -The Strategic Position and Action Evaluation Matrix?

If you’ve used SPACE, either in your academic studies of business strategy or in practice, I’d like to hear about your thoughts and experience so please leave a comment.

Finding Out More About SPACE Analysis

I had to go back to the original book “Strategic Management – A Methodical Approach”, Rowe, Mason, Dickel, Mann and Mockler. Published by Addison Wesley.

The book is hard to find and expensive when new. In my copy of the fourth edition, the Strategic Position and Analysis Evaluation matrix is only covered on pages 255 through to 265.

The good news is that there are a few second hand copies available from Amazon when I checked.