One of the most popular tools in business planning and strategic planning is SWOT Analysis.

What is SWOT Analysis?

SWOT stands for:

- Strengths – factors that are good in the business now

.

- Weaknesses – factors that are bad in the business now

.

- Opportunities – factors that could be good in the future

.

- Threats – factors that could be bad in the future

Image from Jean-Louis Zimmermann

The SWOT Analysis lets you summarise a business strategy and the major issues so that it can be understood quickly and simply. A SWOT matrix – it is usually presented in four sections – is therefore a common element in business plans prepared for bank managers and other financial providers.

According to Wikipedia the SWOT analysis was developed by Albert Humphrey at Stanford University in the 1960s.

SWOT Analysis is a relative tool:

- There must be an overall goal or objective to base the SWOT assessments. Opportunities are things that help you to reach the goal, threats are things that may stop you reaching the goal. As the goal changes, the assessment of the SWOT elements changes.

.

- Strengths and weaknesses are relative to competitors. Let’s jump from business to athletics for a moment. Anyone running in the 100 metres sprint in the Olympics is going to be very fast by normal standards but some runners will have explosive starts and others will finish very quickly. It’s the same in business so don’t confuse qualifying criteria which are necessary to play the game with winning criteria.

What Is TOWS Analysis?

Sometimes the SWOT acronym is changed around to be TOWS – Threats, Opportunities, Weaknesses and Strengths.

Inevitably these are very similar but the emphasis is different.

Strengths and weaknesses focus on the internal aspects of the business while opportunities and threats refer to the external environment.

SWOT Analysis therefore leads with the emphasis on the internal aspects of the business and how they can relate to the external.

TOWS Analysis leads with consideration of the external issues and how they can be influenced or mitigated by the internal issues.

When To Use SWOT Analysis Instead Of TOWS Analysis

Different strategy consultants will prefer one approach rather than the other while others may be flexible and say the use of SWOT or TOWS analysis depends on issues facing the business.

If the external environment is considered fairly certain, then it makes sense to lead with the internal analysis of strengths and weaknesses.

If the external environment is rocky and with high government debts, austerity measures, the potential collapse of the Euro and the knock-on effect of a banking crisis, then it may make more sense in 2011 to lead with the big external issues and identify the major threats and opportunities.

The Importance Of SWOT Analysis

A SWOT Analysis is important for both the person doing the strategic business planning and for anyone reading the business plan and thinking about investing money or time in the business.

For the business manager who is preparing the strategy or the business plan, SWOT analysis helps to avoid a positive bias. An entrepreneur can get excited about an idea and fall into the trap of focusing on the opportunity and the available strengths.

There are important and it is important to play to your strengths but people often fail to implement their business plans because they don’t stop to consider what could go wrong. How weaknesses can prove to be critical and if the gap is closed, then the plan hits a brick wall. Or how external threats can come along and change expectations of the future.

For the reader of the business plan, the SWOT analysis has two important features:

- It provides evidence that the business owner has considered the upsides and downsides and may identify a few issues that the investor wasn’t aware of.

.

- Inevitably the reader of the business plan will be having ideas and may be preparing a SWOT analysis as he or she reads through the plan. Comparing the two versions of the SWOT analysis and finding a lot of common ground can give confidence in other aspects of the plan. Divergence may reveal that the business owner hasn’t given the plan as much attention as it deserves.

Every SWOT analysis is different.

Two businesses in the same industry may have similar goals but very different strengths and weaknesses which could impact on the assessment of the external opportunities or threats.

The same business may consider two different big strategic goals and do a SWOT analysis for each. There are likely to be some common factors to each but there will also be significant differences because particular SWOT elements are relevant or irrelevant to different goals.

Advantages Of SWOT Analysis

The advantages of doing a SWOT Analysis are:

- It is relatively simple to start although it often needs challenging and refining to produce something of value.

.

- Preparing a SWOT analysis is a collaborative exercise and helps to get other management team members involved because it looks across the entire business. Operations people can feel left out when talking about customers and marketing needs but SWOT brings the issues together.

.

- It’s a strategic planning tool that is relevant to small businesses and huge organisations and they can both get something out of thinking about strengths, weaknesses, opportunities and threats.

.

- SWOT is very flexible and can be done for a business or even an individual thinking about changing jobs.

.

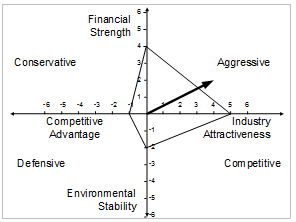

- It is a great way to combine and present insights from the various other strategy tools and models available like the Five Forces, versions of PEST analysis and the Competitive Advantage Matrix.

Disadvantages Of SWOT Analysis

The disadvantages of doing a SWOT Analysis are:

- Doing a SWOT Analysis is not the beginning and end of the strategic planning work. Some people place too much emphasis on it but it is only one tool or common framework.

.

- SWOT Analysis has almost become too familiar and therefore isn’t given the rigorous thought it deserves.

.

- It can become a box filling exercise. The SWOT template has spaces for 6 of each so you get 6 of each meaning some categories are forced and others ignore potentially important issues.

.

- Strengths and weaknesses are often listed as absolutes rather than relative to the competition. I remember one business wanted to export more and listed as a strength that the sales team were learning German which was seen as a potentially big market – but the business would have been competing against German suppliers.

.

- The SWOT analysis is subjective – it is based on opinions and not facts.

.

- Complicated situations have to be simplified to be included with the SWOT analysis and interrelationships may be lost.

.

- Prioritisations of opportunities and threats are often unclear. Expectations are a combination of probability and pay-off/potential cost.

How Not To Do A SWOT Analysis

I have seen some lists of strengths, weaknesses, opportunities and threats where it appears that you go through and cross out the ones that don’t apply and the one’s that you’re left with is your SWOT analysis.

Do not do it like this. Remember GIGO – garbage in, garbage out.

If you’re going to do a SWOT analysis, take the time and effort to think through your business and what’s really happening now and what may happen in the future. It’s the only way you’ll find insight which will help you to make better decisions in your business.

How To Do A SWOT Analysis

A SWOT analysis can be a very simple starting point for strategic planning or it can be part of the end results of a much more elaborate strategic planning process.

It can also be done by one person as a briefing for a management meeting to kick-start discussions or it can be prepared as a group brainstorming session to get the management team involved.

- Start your SWOT analysis by getting clear on your goal and time-scale – for example you could start your SWOT analysis with the challenging objective of “doubling profits within the next year” or “selling $ 1million of exports to the United States in the next six months”.

.

The issues involved with those two different goals are very different and will colour your thinking. The longer the time-scale, the greater the uncertainties that come from the external environment. It’s relatively easy to think 6 to 12 months ahead but much more difficult to think 5 to 10 years into the future.

.

- Decide if you are going to do a SWOT analysis or TOWS analysis depending on whether you think the bigger issues are inside or outside your business. I’m going to assume you stick with SWOT and follow the traditional sequence of strengths, weaknesses, opportunities and threats.

.

- Identify your strengths. I recommend you start off by listing general strengths about the business including special skills and capabilities, resources including people, brands, machinery, money, contacts and relationships.

.

Do a reality check when you’ve got a provisional list of strengths.Are they relevant to the goal you’ve set? If not take them off the list because they are clutter. Yes it’s nice to have a long list of strengths and it may make you feel good if you list more strengths than weaknesses but if any don’t apply, cross them off.

.

Are they a relative strength compared with competitors who may be trying to achieve the same goal. Sometimes strengths fight strengths e.g. relative buying power of two businesses may give one a cost advantage, other times strengths fight against weaknesses.

.

- Identify your weaknesses relative to the goal. What could stop you from achieving it that’s a factor inside your business. This time it might be a lack of skills and capabilities, resources including people, brands, equipment, money, contacts and relationships.

.

Threats may include an over-reliance on one or two key people. If anything were to happen to them (and it may include you) then your plans may be in disarray.

..

- Switch from looking inside the firm and look outside. It can be useful to run through Michael Porter Five Forces model of industry analysis and wider environmental scanning like PEST (Political, Economic, Social, Technological) which are combined in the SKEPTIC environmental scanning model.

.

Some external forces nag away at managers as a constant source of concern and they don’t need any help to identify them but others, potential just as big but not as tangible today need some coaxing out of minds onto paper.

.

- Identify the positive forces and opportunities which may help you to reach your goal. These may include a rapidly growing market, changing customer tastes in favour of your product, general economic prosperity, favourable exchange rate movements which are particularly important if you are exporting/importing while your competitors are domestically based.

.

- Identify the negative forces and threats in the external environment which may stop you from reaching your goal. Threats and opportunities can be prioritised by assessing the probability of them happening and their likely impact. The tsunami and nuclear power problems happened in Japan earlier in 2011 and were devastating but the threat had existed for many years. Then consider grading from 1 to 5 or high, medium and low to help you to prioritise and keep the SWOT matrix focused on the big issues.

Practical Tips When Preparing Your SWOT Analysis

Sometimes you’ll look at a particular issue and think it could be a strength or a weakness, or an opportunity or a threat. If it’s minor, ignore but if it could be a big issue, split it into two aspects and list as both

e.g. strategic issue – technology is very close to allowing the super widget to be created.

Opportunity – being first to market with a reliable super widget will create a huge buzz inside and outside the company.

Threat – competitor A is working on a super widget prototype and, if it works, prices are normal widgets could fall sharply.

When looking at your products or services for strengths and weaknesses, try to see through the eyes of customer. We all have a tendency to fall in love with our own products so use customer feedback from surveys, complaints and informal discussions.

Try not to be overly critical or positive. I’ve seen SWOT matrices where it is clear there is positive or negative bias.

Don’t try to create equal numbers just for the sake of making the chart look sensible but if it looks unbalanced, have a think about the other squares. How is your business performing? If it is doing well, especially when compared with competitors, then it’s likely you have more strengths. If is is struggling while competitors are prospering, then you have weaknesses.

Using A SWOT Analysis

There are two elements to SWOT analysis:

- Putting the matrix together

.

- Drawing conclusions that influence decisions and actions

Get a view on your strategic position compared to competitors. Is it strong, average or poor? Does the future look full of promise or can you expect things to be difficult over the next few years?

The SWOT Analysis gains much more power when you use the internal logic to help you to think about strategic options rather than just using the SWOT matrix to summarise what you intend to do. That is, you can start looking at the dependencies between strengths, weaknesses, opportunities and threats.

There are four options within the SWOT analysis matrix:

- Strengths & Opportunities – how you can use the strengths within your business to take advantage of opportunities in the external environment – this is an offensive strategy where you are taking the imitative and making good things happen.

.

- Strengths & Threats – how you can use your internal strengths to make sure that external threats don’t cause severe impacts on your business. Like much of SWOT thinking, this is relative to competitors and “forewarned is forearmed” is an effective way to think about these issues.

.

- Weaknesses & Opportunities – what you can do to stop existing internal weaknesses affecting your ability to take advantage of opportunities.

.

- Weaknesses & Threats – what you can do to stop internal weaknesses compounding with external threats – for example you may believe that you have a higher break even level than competitors and if you sense difficult times ahead, you can take action now to reduce your fixed costs or improve contribution margins.

SWOT Analysis Template

You can search on the internet for a SWOT analysis template but really there is nothing to it.

If you go into Word and create a 2 x 2 table and head up the top two columns Strengths and Weaknesses and the bottom two columns Opportunities and Threats and then click on the order list or bullet points for each table cell, you have built your own SWOT template. These have the advantage that provided you are brief, you can get the entire SWOT matrix on one page.

For TOWS analysis you just reverse.

You don’t have to follow the 2 x 2 matrix format so you can create a 1 column 4 row table instead and give more details. This allows you to capture more fully your thoughts and issues on the individual strengths, weaknesses, opportunities and threats but you lose the advantage of seeing the entire SWOT analysis on one page.

Some business planning software has a SWOT analysis template included.

SWOT Analysis & Differentiation

If your business has been following a differentiation strategy and you have established a clear gap between you and your competitors, then strengths may include:

- Customer loyalty & high levels of satisfaction

.

- Strong brand and reputation – the business name means something

.

- Ability to charge a price premium and make higher profit margins

.

- Patents that stop competitors imitator key parts of the product

Weaknesses may include:

- Higher costs

.

- Lost competitiveness on one customer value criteria you believe is important because a competitor has innovated in a way that you didn’t expect.

Opportunities may include:

- Strengthening the differentiation advantage

.

- Taking those advantages and expanding into new markets.

Threats may include:

- Changes in customers needs, wants and tastes -these will change the appeal of customer value attributes and their relative importance.

.

- Losing focus on the key differentiators by trying to broaden customer appeal too much.

SWOT Analysis Examples

I believe very strong that your SWOT analysis should be different from in some respects to your closest competitors and I’m wary of using SWOT proforma checklists and ticking off those that apply.

However if you search the Internet, you will find plenty of SWOT examples all the way down to individual businesses (for business student questions like “What are the important factors a SWOT analysis for Google will show?”) and for trade and industry sectors like restaurants, hotels and retailers.

You can use these SWOT examples in two ways:

- To get you started – sometimes it is tough starting with a blank piece of paper or your SWOT template although some SWOT issues are usually very clear.

.

- To help you to review what you’ve included in your SWOT analysis. This is particularly true if you are preparing your SWOT matrix without doing the strategic analysis from the Five Forces, PEST and customer value analysis.

Feedback On My SWOT Analysis page

Have you found my summary of SWOT analysis helpful?

What points would you emphasise about doing a SWOT matrix?

Let me know please by leaving a comment.